Prosperity

The Prosperity Memo outlines the key findings, maps and tables for the various topics related to community and individual prosperity. Topics in this report include economic development, housing and fiscal conditions.

Key Findings

- The economic activity in Wabash County is worth $1.2 billion and has grown by three percent from 2015.

- There are just over 700 businesses, down from a high point before the 2008 national recession.

- Wabash County has experienced little recent growth in its property tax base, which puts pressure on property tax rates and the ability to fund public services.

- Wabash County has prioritized the local income tax in its fiscal policy. The county has seen significant recent income tax revenue growth.

- The vast majority, 80% of the housing units, are single family

- 19% of the county residents are “housing cost burdened”

Prosperity

Economic Development

The purpose of the Economic Development Technical Analysis is to provide a common set of facts regarding the performance of the County economy, and the status of its workforce. These facts in addition to interviews, and other targeted analysis are to support the creation of the economic development element for the County Comprehensive Plan.

- The economic activity in Wabash County is worth $1.2 billion and has grown by three percent from 2015.

- There are just over 700 businesses, down from a high point before the 2008 national recession.

- Annual average wages have increased in real terms since 2010 by 10% but lags the state average by $10,000

- Local labor needs (workforce) are met by the region – and the County’s employment needs (jobs for residents) are also met by the region.

- 22% of county residents commute more than 50 miles for employment

- Workforce in several industries is older than the state of Indiana

Fiscal Capacity

Understanding the fiscal environment is critical to realistic, actionable, long-range planning. This chapter provides an overview of the current tax and revenue structure of Wabash County and its municipalities to understand the tools available to support the planning process.

Key Findings

- Major sources of local revenue are property taxes and income taxes.

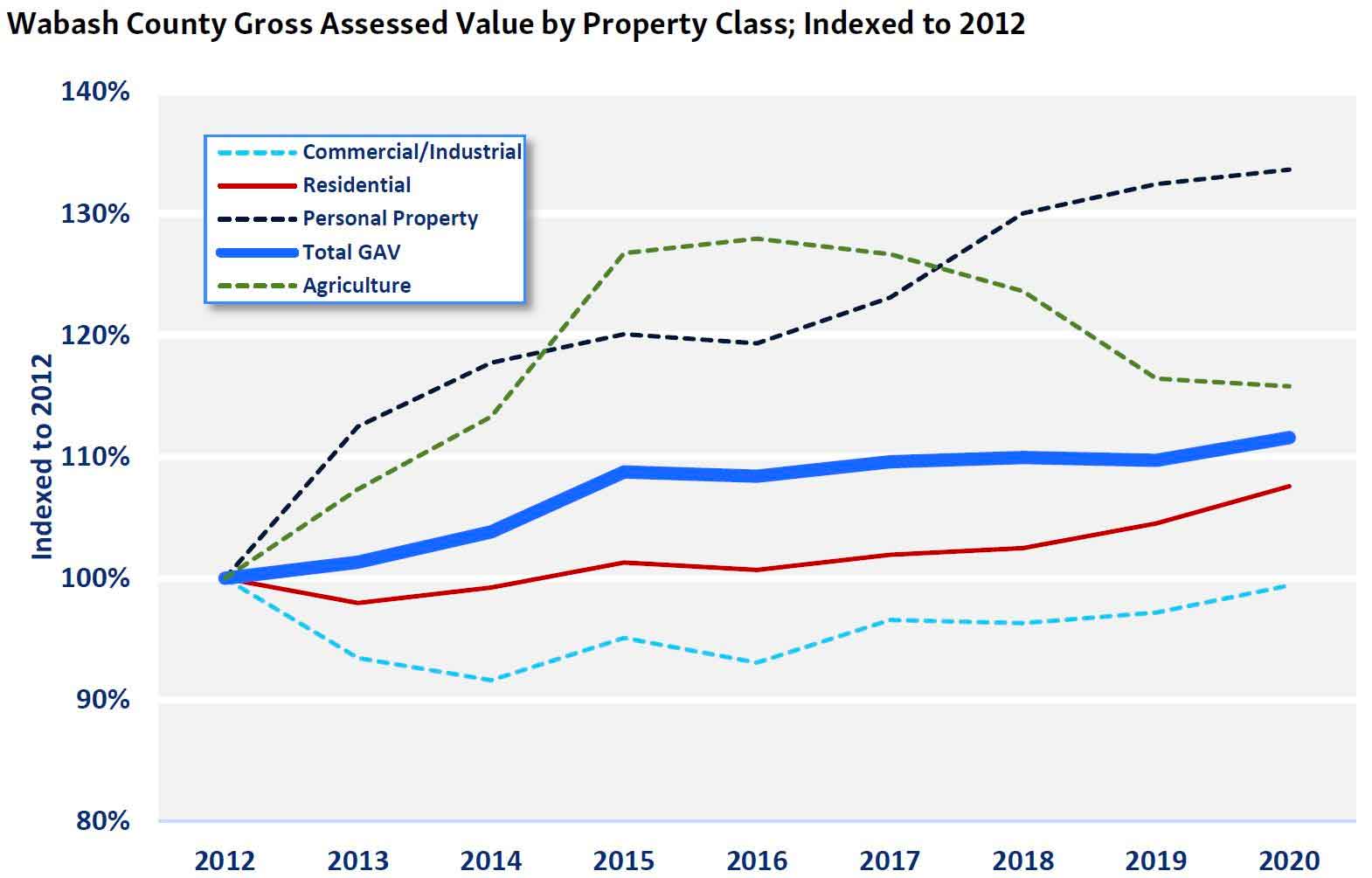

- Wabash County has experienced little recent growth in its property tax base, which puts pressure on property tax rates and the ability to fund public services.

- Circuit breaker impacts are relatively low in most of the county but are an emerging issue for the Wabash Civil City.

- Wabash County has prioritized the local income tax in its fiscal policy. The county has seen significant recent income tax revenue growth.

- The current income tax rate is near the statutory maximum for budgetary revenues, leaving little capacity for rate growth.

- Untapped revenue streams such as the Food and Beverage Tax and Wheel Tax/Surtax could generate revenue for future capital projects.

Housing

The purpose of the Housing Technical Analysis is to provide a common set of facts regarding the state of housing in Wabash County. These facts are to support the creation of the housing and land use elements for the County Comprehensive Plan.

Key Findings

Wabash County Housing…

- Consists of 14,000 housing units

- Of which, 39% was built before 1939

- The vast majority, 80%of the housing units, are single family

- Limited new construction since 2009

- 19% of the county residents are “housing cost burdened”

- Has been rising in value faster than the state

- Housing values have grown almost 3x of wages

.png)